Chapter 2 – Strategy, Goals and Materiality

Strategy, Goals and Materiality

Sustainability Strategy Development

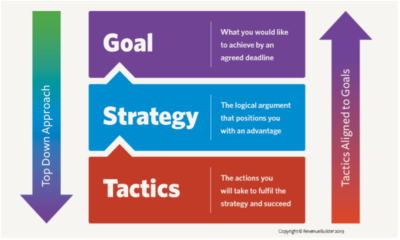

Strategic planning has long played a role for companies in looking to their future. As part of the strategic planning process, companies consider their mission and goals to build out their corporate strategies.

Similarly, in developing a specific sustainability strategy, the process itself will guide and inform the development of sustainability goals, strategy statements for these goals, and the tactics for implementing a broader strategy.

Goals are broad, long-term outcomes that are reasonable to achieve within a time frame and with available resources.

Goals are broad, long-term outcomes that are reasonable to achieve within a time frame and with available resources.- A strategy is a specific approach that will be used to meet objectives.

- Tactics are the specific actions a company will take to succeed with its strategy.

Remember: Sustainability is not simply a marketing function showing the positive aspects of a company. There is a natural tendency to highlight positive performance (e.g., reduction in fatality rates) and underplay poor performance (e.g., increasing carbon emissions). However, stakeholders would rather see that a company has a well-thought-out sustainability strategy, understands what the core risks (and opportunities) are, and that its management is taking steps to address them, rather than be presented with an overly optimistic picture.

Strategy Starts with Materiality

Sustainability covers a very wide range of potential topics, and your company can’t address them all–many may simply not apply to your operations, or may not have a significant influence on your company’s success or its impact. In order for your company to effectively develop a sustainability strategy and program, you must first identify and prioritize the issues that are most relevant to the company’s stakeholders. This process is called a Materiality Assessment.

Materiality is the concept that certain issues are more relevant, or ‘material,’ to your company’s operations and impact than others. The Global Reporting Initiative (GRI) defines material topics as topics that “represent an organization’s most significant impacts on the economy, environment, and people, including impacts on their human rights.” How your company addresses these issues plays a critical role in sustainability program development.

Later in this chapter we will go into more detail on the materiality assessment process. Before you can go further into your strategy development, you’ll need to complete this process by:

First – understanding the organization’s context.

Next, engaging with relevant stakeholders and experts on the following steps:

- Identifying actual and potential impacts; and

- Assessing the significance of the impact.

Finally, testing the material topics with experts and stakeholders, both internal and external, and against the topics in the SASB/IFRS Sector Standards. Use this feedback to prioritize the most significant impacts to create a list of Material Topics.

Goal Setting as the Foundation for Strategy Development

Once your organization’s material topics have been identified, it is time to set goals. Sustainability goals communicate intention to your stakeholders. Further, there is evidence that setting goals, with transparent reporting on their progress, drives action – increasing the likelihood of achieving them.

SMART Goals

Committing research and analysis behind the goal setting process helps create buy-in and build credibility with all internal and external stakeholders. Your goals should be SMART: Specific (S), Measurable (M), Achievable (A), Relevant (R), and Time-Bound (T).

Specific. Goals should not be too broad or vague. A goal such as “Be an environmentally-friendly company” would not be specific enough.

Measurable. Create goals with clear boundaries and definitions for success that can be measured and reported annually. Ask yourself whether you will clearly know whether or not the goal has been achieved.

Achievable. Sustainability or ESG goals historically have been either aspirational or designed with realistic specifics to improve the chances for successfully achieving them. As part of an internal process, a company will need to decide on their approach to goal setting:

- Aspirational Goals set high benchmarks but may not be achievable. As goal dates are passed, a company’s integrity may be questioned. If a company doesn’t meet the goal, it may be accused of greenwashing.

- Realistic, achievable goals built by research may not sound as impressive but allow the opportunity for success. At the same time, there is some risk that stakeholders may think the goal doesn’t aim high enough, but benefits are the likelihood for reporting success in achieving them.

Increasingly we see companies focusing on developing 3-5 aggressive, but realistic high level goals that a company can build a strategy around. Obtaining corporate buy-in is an important part of this process, helping to ensure future success.

Relevant (aka Material!): Goals should be tied to your company’s material topics. In developing an sustainability strategy, starting by identifying the material topics that are important to a company’s stakeholders will ensure that goals are consistent with stakeholder priorities. Your Materiality Assessment will inform this process of identifying specific and appropriate goals. The goals will become the guiding principles for the company in regard to sustainability and are foundational to the development of a sustainability Strategy.

Time-bound. All your goals should include the date by which you intend to achieve the goal. Dates for short, mid-, and long-term goals should be clearly defined and realistic for each type of goal.

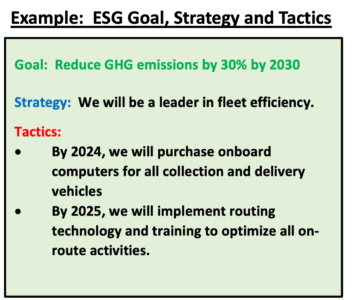

Strategy Statements for Each Goal

Once the company has determined its goals, it is time to write strategy statements for guiding how you will achieve each one. An important process in developing these statements is stepping back to determine what is currently standing in the way of successfully achieving the goals. What needs to change to achieve your goals? Creating the strategy to overcome these obstacles creates the path to effectively reach the goals.

Each of your goals needs a strategy statement to provide the ambition for how the goals will be achieved. Your goals state where you are going, the strategy statement is how you will get there.

Identifying Tactics

Tactics are the details of the actions you will take to execute each strategy which will achieve each goal. Tactics include programs, specific investments, equipment purchases, and other actions that will ensure the success of each goal. Taking the time to set up goals and strategies first will increase the chances for developing the right tactics, which, in turn, increases the chances for achieving each goal.

Sustainability Strategy Process Summary

Developing a Sustainability or ESG strategy does not need to be complicated:

- Use your materiality assessment to identify possible goal topics.

- Develop goals statements.

- Create target goals.

- Create strategy statements to identify what you need to achieve your goals.

- Develop tactics for implementing the actions needed to achieve your goals.

- Track progress and report annually.

For a full review of the Sustainability/ESG Strategy process, see ESG Workshop #2: (download slide deck)

Materiality Assessments, Step-by-Step

Here’s a step-by-step guide to conducting a Materiality Assessment:

1. Understand the Context

Create a high-level overview of community and business relationships, the sustainability context in which these occur, and an overview of your stakeholders. This provides you with critical information for identifying your company’s actual and potential impacts.

As part of this activity, consider:

- The organization’s purpose, value or mission statement, business model, and strategies;

- The types of activities your company carries out (e.g., sales, marketing, manufacturing, distribution) and the geographic locations of these activities;

- Products and services offered;

- Sectors the company is active in; and

- Number of employees & employee types.

Consider your business relationships, the nature of these relationships (long term/short term project or event), and your geographic location(s). To consider the sustainability context of activities and business relationships, consider:

- Economic, environmental, human rights, and other societal challenges at local, regional, and global levels related to the organization’s sectors and geographic location of its activities and business relationships (climate, poverty, water stress);

- Regulatory environment; and

- International labor principles.

Next, draft a full list of individuals and groups whose interests are affected or could be affected by your company’s activities, and ask them about the ESG topics that are most important to them. Stakeholder engagement should include:

- Employees,

- Customers,

- Regulators,

- Investors, and

- Community stakeholders.

Make sure to identify individuals or groups your company does not have direct relationships with, but who could be affected by the company’s activities.

2. Identify potential and actual impact areas

SASB/IFRS has identified a list of relevant material topics for the waste/recycling industry: GHG Emissions, Air Quality, Waste & Hazardous Materials Management, Labor Practices, Employee Health and Safety, and Business Model Resilience. This is a great starting point for an initial list of potential material topics.

3. Assess Significance

Using this list of potential topics, an organization can understand the key area of concerns of its stakeholders through surveys and interviews, to find out which topics are of most importance, and if any additional topics need to be considered.

ReMA has created a Materiality Assessment Survey Template for our members to use as a starting point for creating your own stakeholder survey.

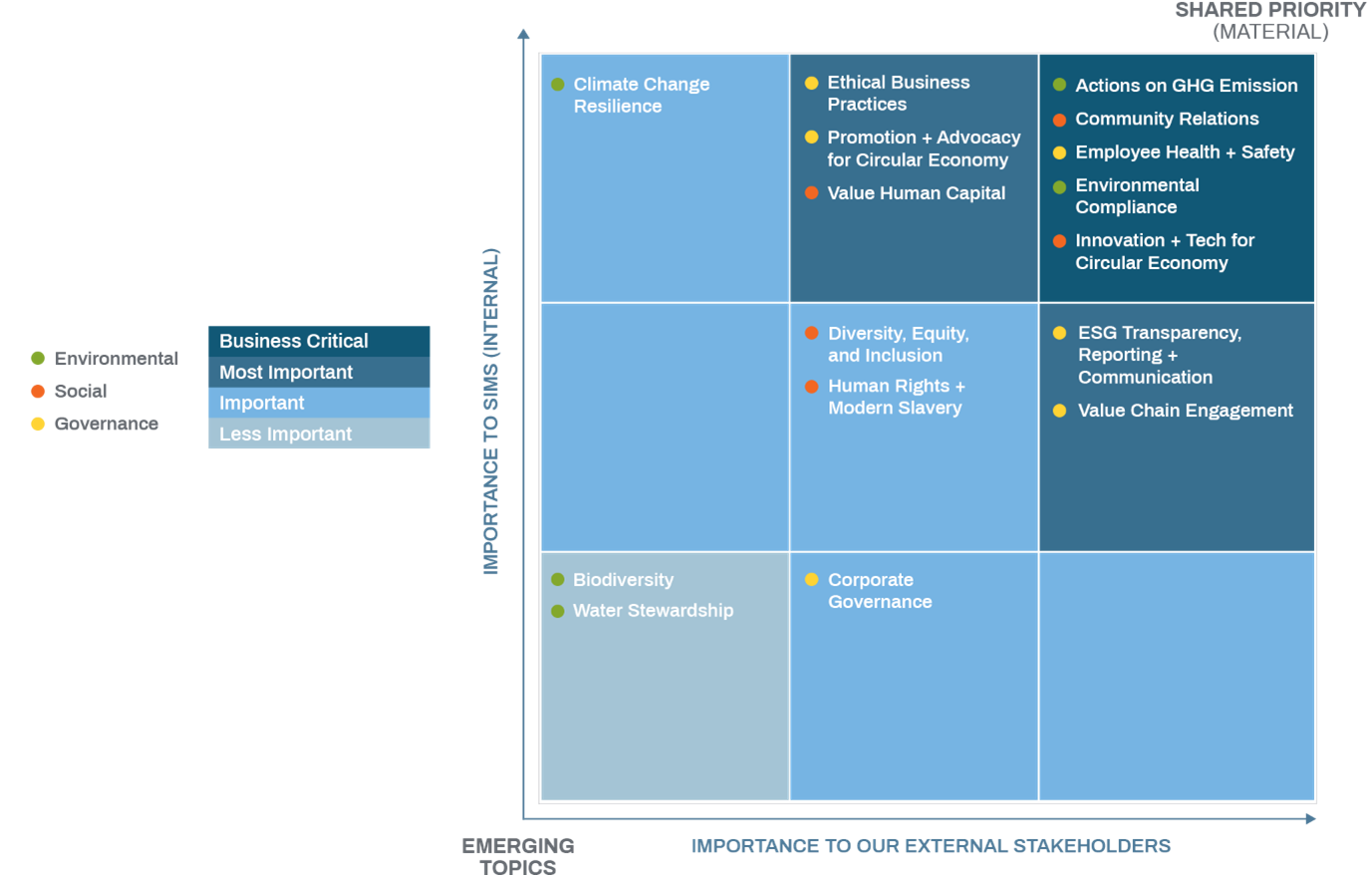

4. Prioritize

Finally, the company can identify its material topics and prioritize its impacts based on their significance.

This exercise is not intended to reflect whether your company believes an issue is important in general terms. Rather, it is aimed at assisting you in prioritizing among possible ESG issue areas and enabling you to focus on those that are most important to your stakeholders, as well as an external signal to stakeholders on how your business applies its focus.

Here is an example of the end result of a materiality assessment, from Sims Metal:

Our June 2023 workshop covered the Materiality Assessment process, topics, and surveys (download slide deck):

Material for Whom?

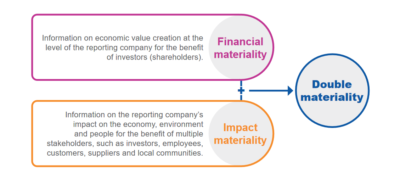

Throughout this chapter we have referenced your stakeholders and your company’s impact as the factors that determine materiality. Different regulators and standards agencies bring their own lens the question of which impacted stakeholder groups are foregrounded, which has led to some variation on the concept of materiality. You might encounter the terms ‘financial materiality,’ ‘impact materiality,’ and ‘double materiality.’ Since this toolkit relies on GRI, this toolkit’s guidance is based on their framing of impact materiality. GRI has illustrated these concepts in the graphic below: