Chapter 8 – Climate Risk & Business Resilience

Climate Risk & Business Resilience

What is Business Resilience?

How a business recovers from little or big crises can be more important than whether they happened or not. We all know that things go wrong. Business resilience is about preparing your company to handle a disruption, resolve it, and even build trust and loyalty through being ready and responsive.

The entire field of business continuity has developed processes for assessing risk ahead time, and developing mitigation and recovery plans for resiliency in the face of physical disasters, employee relations issues, IT disruptions, and more.

Business risk mitigation involves more than just one company’s planning. Your resilience depends on the resilience of your supply chain and your employees. If you operate a fleet trucks, of how prepared is your fuel supplier to handle a disruption? If you have employees in more than one state or city, are there extreme weather events that may impact those employees even when the rest of the company is operating as normal?

Business resilience means investing in systems, infrastructure, and emergency planning that will protect economic productivity, employee well-being, and long-term competitiveness. It is the ability to anticipate, respond to, and recover from disruptive events. For recyclers, resilience planning isn’t just risk management, but an opportunity to lead.

What is Climate Risk Assessment?

Climate change is affecting the types of disruptive events, frequency and magnitude of them and in turn is influencing the business and regulatory environment that companies operate in. Climate risk assessments help you understand how your business’ risks tomorrow might be different than they were yesterday due to the impact of climate change.

Building your company’s resilience in the face of climate adversity offers the opportunity to prepare and excel in the future. The companies best equipped to withstand and adapt to climate change will be those that thrive in the long term.

How is Climate Change Affecting Business Risks?

Climate change has significant impacts for the financial stability of companies. Climate-related risk refers to the potentially negative impacts of climate change on an organization. They can affect an organization’s operations, infrastructure, people, and economic stability. As climate change accelerates and global climate systems destabilize, these risks become much more frequent and destructive.

Risks include:

- Impacts on services and physical infrastructure due to climate change.

- Adverse effect on lives, livelihoods and health

- Policies and technology shifts that may impacts operations, consumer preferences and economics

Some of the most visible and immediate implications of climate risk come in the form of extreme weather—disruptions caused by flooding, storms, wildfires, and other natural hazards. However, climate-related risks extend much further than individual weather events. They are broad in scope, affecting not only physical infrastructure but also livelihoods, public health, environments, and consumer expectations.

These risks are generally categorized by short-term or long-term risks:

- Short-term risks include more frequent and intense storms and flooding.

- Long-term risks include slower-developing climate issues with more lasting implications, such as rising average temperatures and shifting weather patterns.

According to the World Economic Forum, three of the top 10-year global risks are directly related to climate:

- Extreme weather events,

- Critical changes to Earth systems,

- Biodiversity loss.

Unlike other types of business risks, climate-related risks are deeply systemic. They are caused by both environmental hazards and the rapidly changing social, economic, and political landscapes surrounding climate action.

Types of Climate-Related Financial Risk:

- Physical risks. This is the damage to fixed assets, like buildings and property. These are common physical risks associated with climate change:

- Heatwaves

- Droughts

- Water Stress

- Intense precipitation

- Floods

- Increasing average temperature

Physical risks include the increased frequency of acute single weather events like a hurricane, and long-term chronic stressors like higher average summer temperatures.

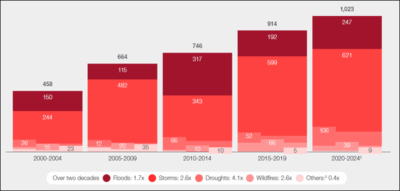

The cost of damage from storms and heat-related events has more than doubled in the past 20 years from $458 billion to over $1 trillion.

-

Transition risks. Regulatory risk, such as climate laws and policies affect how companies operate. For example, litigation that targets companies for contributing to climate change, e.g. oil companies. They also include the potential cost of new technologies and customer preferences for products and services related to transitioning to lower-carbon energy.

How Do You Assess Your Own Company’s Risks & Plan Around Them?

- Identify potential threats to your business.

- Risks can include natural disasters, cybersecurity incidents, health events, geopolitical events, supply chain disruptions, and human error.

- Consider different scenarios where climate change might impact what these threats might be, from a physical and transition perspective.

Resources: The FEMA National Risk Index map is a good place to start for physical risks in the areas where you operate.

NOAA’s Climate Mapping for Resilience and Adaptation Map & Assessment Tool can help project future climate conditions.

- Determine how your identified risks could impact your business

- Define the critical things you do, and the resources you require to do it: the people, facilities, network, vendors, software, equipment, and supply chain requirements.

- This is sometimes called a Business Impact Analysis, but it can be as simple as asking yourself “What do absolutely we need to work right?” What is the key information, who are the key people, or what are the key facilities or equipment that you cannot operate without?

Resource: Ready.gov’s Risk Assessment Tool provides a simple table for identifying & assessing the level of risk.

- Create Recovery Solutions.

- Come up with potential solutions for what you would do if one of your crucial resources was unavailable. This could mean identifying backup suppliers, cross-training additional staff, or planning to move a function to another facility temporarily.

Resource: The U.S. Small Business Administration’s Business Resilience Guide includes suggested low-, mid- and high-cost mitigation strategies to protect buildings from for natural disasters, including high-wind events, earthquakes, extreme weather, and flooding (see pg.17).

- Train and exercise.

- Train your team on the recovery solutions you’ve created.

- Gather key leaders once a year and complete a (see sample scenarios in slide 32 of our March webinar) to test your plans.

- Evaluate and learn from your mock exercise and any unexpected event that wasn’t in your plan already!

Who Is Asking for Climate Risk Assessments or Business Continuity Plans?

Regulators

- U.S. – California’s Climate-Related Financial Risk Act (2024). SB 219 modified several other climate change laws in the state (SB 253 & SB 261). Specifically, SB 261 requires companies with more than $500 million in revenue that do business in California to report climate-related financial risks and measures to address those risks starting in 2026.

- European Union. The EU Taxonomy and the Corporate Sustainability Reporting Directive (CSRD) include requirements for companies to assess their exposure to climate-related risks. CSRD focusing on identifying and assessing physical and transitional climate-related impacts, risks, and opportunities on company level.

Resource: Ramboll’s global map shows the current state of proposed & implemented regulations on climate change risk disclosure.

Customers & Investors

- Companies are increasingly recognizing the role that their supply chain play in the risk assessment process. A company’s supply chain can be a benefit or a liability, creating significant financial impacts.

- Vendor/supplier “readiness” impacts a company’s ability to adapt and respond to climate related risks.

- Your customers may report to organizations that rate companies based on criteria that include climate change scenario planning. CDP, GRI, and IFRS2 include climate change scenario assessment requirements, which would include assessment of key suppliers’ risks & readiness. These reporting frameworks are also used by investors.

Insurers

Increasingly, insurance companies are requiring companies to have business continuity plans in place.

Who Can Help?

- Ready.gov: Business disaster planning kits and other resources

- DisasterAssistance.gov: A directory of 70+ federal disaster assistance programs/resources.

- FEMA Recovery Resource Guides: State-specific guides for states impacted by recent emergencies.

- Small Business Administration:

- Beforeduringafter.com: A Texas-based resource with general applicability on business continuity & resilience

Note: Content for this chapter was derived from ReMA’s March 2025 Sustainability Webinar Series session, with guest speaker Megan Levy of Texas Mutual.